October 1st, 2015

George Osborne revealed a shake-up in the way dividend income is taxed in the Summer Budget 2015. It was announced that the taxation of dividends would be changed from 6 April 2016 through the fanfare of removing many from paying tax on dividends. The reality for business owners of limited companies is anything but and it now appears that they are paying the price for the Government's commitment to reducing the main rate of corporation tax.

The TolleyGuidance news item below brings the real impact to life and provides practical insights into what may come next.

Introduction

[UPDATE: This news item was updated on 4 September 2015 following clarification by HMRC as to how the dividend allowance will operate. See the HMRC factsheet for more information.]

It has only been a few weeks since the Chancellor's announcements at Summer Budget 2015. As the dust settles, it's clear to both advisors and business owners that the taxation of small businesses is back to the top of the agenda. Certainly, despite the welcomed announcement of corporation tax rate reductions, the proposed changes in dividend taxation certainly mean less of those pounds earned being kept in the typical owner/ manager pocket.

Proposed changes

The government will legislate to reform the basis of dividend taxation in Finance Bill 2016, so it is expected that following consultation we will only get a clear confirmation of the position at Autumn statement 2015 later this year. Making the reasonable assumption that the announcements made at the Summer Budget will apply from 6 April 2016, the changes will be as follows:

- the dividend tax credit will be repealed

- a new dividend allowance of £5,000 per year will be introduced (this does not reduce total income, but essentially taxes the first £5,000 at a 0% rate, so reduces the basic and higher rate bands), and

- the rates of tax on dividend income will increase to 7.5% for basic rate taxpayers, 32.5% for higher rate taxpayers and 38.1% for additional rate taxpayers. Conveniently this appears to fall out side the protection of the new 'tax lock' for headline income tax rates

Profit extraction cost

The observant amongst you will know that the answer to the perpetual 'salary versus dividend' question asked by clients has generally always been that dividends are best from a tax perspective. Notably this is because no national insurance liability accrues on dividends, though of course sufficient distributable profits must be available in order to ensure that a legal dividend can be declared and paid.

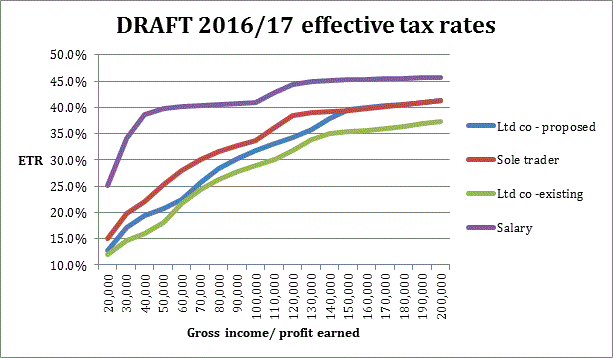

The following graph shows that as part of his policy to remove perceived imbalances in the tax system, the Chancellor is closing the tax gap between extraction of profits by way of salary or dividends. The graph is based on current announcements including that the NIC upper earnings/ profits limit increases to £43,000 (for Class 1 and 4 NIC) and that the owner / manager extracts a salary of £8,112 (the employers NIC threshold), with the remainder taken as dividends.

As you can see above, there is still a small tax benefit in operating as a limited company as opposed to a sole trader though this disappears around profits of £140,000. On average, up to £200,000 of profits, the marginal effective tax rate benefit on extracting profits from a company as compared to operating as a sole trade will now only be around 1.4%. This compares with a benefit of around 5.1% in 2015/16.

For companies with lower profits (up to £100,000) the benefit is now 3.5% on average, but nevertheless operating, as a limited company will certainly not be as attractive as it is now.

Dividends as the 'top slice' of income

For those receiving dividend income, it is always important to consider the tax impact of dividends being the 'top slice of income'. If we just look at the marginal rates on paying a dividend, the cost has increased by 7.5%:

| 2016/17 | 2015/16 | |

|---|---|---|

| Basic rate | 7.5% | -- |

| Higher rate | 32.5% | 25% |

| Additional rate | 38.1% | 30.6% |

For higher and additional rate payers who receive dividends as the top slice of income then only when dividends paid exceed £21,667 and £25,400 respectively will an additional cost arise, as compared to 2015/16. Notably for owner/managers extracting profit using low salary and dividends utilising their basic rate band, there is an immediate cost once dividends paid exceed the £5,000 allowance.

Consideration will also need to be given where taxpayers are close to the higher or additional rate thresholds as the dividend allowance, whilst tax free, will push income into higher marginal rates. The following table shows the additional tax cost where £5,000 of dividend income is pushed into the next marginal rate of tax:

| Dividend income taxed at: | £ |

|---|---|

| Higher rate (£5,000 x (32.5% -- 7.5%) | 1,250 |

| Additional rate (£5,000 x (38.1% -- 32.5%) | 280 |

Therefore it may be worthwhile deferring payments or ensuring all options have been explored to extract profits in a tax efficient manner.

What next?

It is clear that this will be of keen interest to owner/managers, but we await draft legislation to confirm the implications. It should certainly be high on the agenda at year-end planning meetings in early 2016, and taxpayers may wish to explore:

bringing forward the payment of dividends into 2015/16. This will require careful consideration of company law procedures to ensure the date of payment arises in 2015/16 and evaluating the benefit of a lower liability versus earlier tax payment

postponing dividends to ensure that sufficient reserves are maintained in anticipation of any possible future transactions, for instance a share buyback

utilising the proposed £5,000 annual dividend allowance each year

extracting profits by way of director's loan account (25% corporation tax charge and a beneficial loan (3% interest rate since April 2015))

maximising tax efficient profit extraction, eg pension contributions and other tax free benefits

There will, of course, be many permutations and it will depend on each individual taxpayer's needs.

In terms of the Government's strategic plan of preventing tax motivated incorporations, it remains to be seen whether the proposed changes will have the desired effect. However, it is clear that there are many commercial reasons that result in businesses choosing the corporate veil of a limited company rather than an unincorporated structure, and the marginal benefits may still be worthwhile in these situations. It also remains to be seen what will be the future impact of HMRC's ongoing efforts to improve the effectiveness of IR35 and the Office of Tax Simplification's continuing review of closer alignment of income tax and NIC. What is probably certain is that until the UK's deficit is under control, the tax burden for virtually everyone is likely to go up.

Helpful guidance

The small companies extraction of profits guidance will help you in this area. Specific guidance notes, which will be useful when exploring the related issues, are:

You may also be interested in

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Proin ac leo sollicitudin, sodales dui sagittis, porttitor nisi.

- Mauris lacinia nisl non risus blandit pellentesque.

- Integer fringilla velit lorem, vel bibendum neque cursus id