February 7th, 2015

The Tax Pathway is a new route to membership of both the Association of Taxation Technicians and the Chartered Institute of Taxation and brings together the exceptional tax compliance knowledge delivered by the ATT qualification with the CTA, the gold standard of quality for tax professionals. The Tax Pathway enables students to study for both the ATT and CTA qualifications and become members of both bodies in less time, without reducing the quality and rigour of the qualifications. It is ideal for both new students and current ATT students who are able to transfer onto the Tax Pathway provided they have completed no more than two ATT papers (and the CBE's).

Benefits of the Tax Pathway include:

- Cost effective – students following the Tax Pathway route will spend less time out of the office as they will have one fewer exams to sit. The cost of qualifying is likely to be less than following the sequential qualification route for ATT and CTA.

- Early qualification – as the Tax Pathway provides a combined route to both the ATT and CTA qualification, students will be able to sit more exams earlier.

- Flexibility - students can choose which ATT papers they sit, as papers are no longer mandatory.

- No prerequisites – students don't have to hold any particular qualifications or have any specific experience before starting the Tax Pathway.

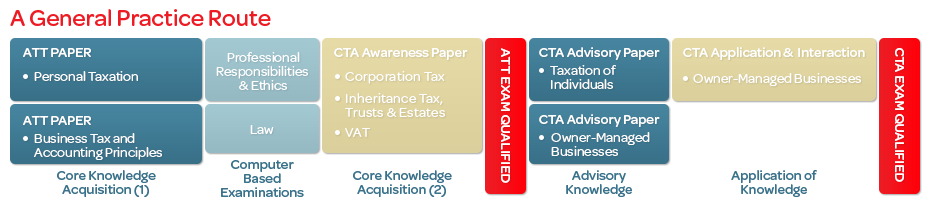

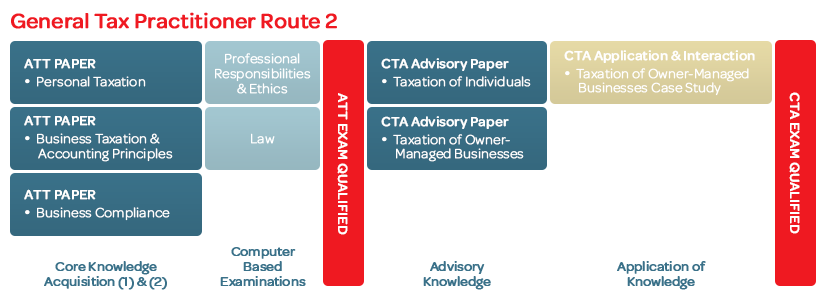

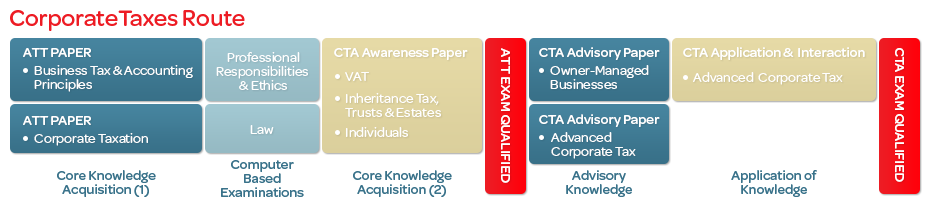

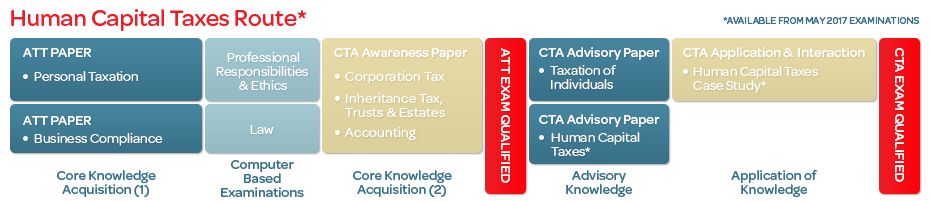

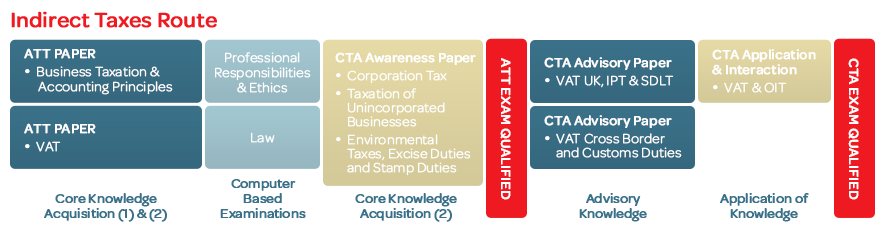

- The Tax Pathway is structured into 5 key elements (see illustration)

1. CORE KNOWLEDGE ACQUISITION 1

Students sit two ATT papers of their choice. There is complete flexibility as to which papers are taken. These two papers must be sat and passed before the CTA Advisory or CTA Application and Interaction elements are attempted.

These papers are sat in May and November each year and you can sit any number of papers at a time. The pass mark for each certificate paper is 50%. The results are released in January for the November examinations and July for the May examinations.

2. CORE KNOWLEDGE ACQUISITION 2

Students can either sit a third ATT paper, or the CTA Awareness paper. At this point, students should note that if they choose to sit the Awareness paper, the modules they take cannot be the same as those taken at the CTA Advisory stage.

3. LAW AND PROFESIONAL RESPONSIBILITIES & ETHICS COMPUTER BASED EXAMINATIONS

This stage comprises the Law and Ethics examinations, which are assessed as Computer Based Examinations (CBEs). These examinations are a core part of the ATT and CTA qualifications so must be passed before ATT membership can be achieved. Both examinations must be passed before you can enter for your final written CTA paper.

Each Computer Based Examination is a one-hour online examination of multiple choice and multiple response questions, which you can sit at any time during the year.

The pass mark for the Computer Based Examinations is 60% (30 correct answers out of 50 questions). You receive the results from the Computer Based Examinations after it is attempted.

At this point, students are eligible for ATT membership provided they have also achieved two years' work experience in taxation

4. ADVISORY KNOWLEDGE

In this stage, students sit two CTA Advisory papers. If the student has already taken three ATT papers, then the student can choose freely which Advisory papers they wish to take. If the CTA Awareness paper has been taken, then the Advisory papers must cover different specialisms.

5. APPLICATION AND INTERACTION

Students can select the appropriate case study question from the Application and Interaction paper.

At this point, students are eligible for CIOT membership provided they have also achieved three years' work experience in taxation

Over the last 13 years Tolley Exam Training has grown rapidly by providing a unique service to our clients, and in the process, changed the way that students and clients view and undertake studying for the professional tax examinations.

Our aim is simple - Delivering unrivalled results

Year on year, Tolley Exam Training students achieve exceptional exam results that significantly surpass the national average. This has been achieved through:

Writing by experts

Our expert writers create engaging and comprehensive study manuals to help students' understand the fundamental principles. Our targeted study material, which enables students to focus specifically on the requirements of their particular examination. Our comprehensive and flexible online study package lets them make the most of their study time, and study whenever and wherever they want. Tolley Exam Training also offers a range of study packages and provides detailed guidance for the Computer Based Examinations, which use a very different style of question requiring specific learning techniques.

Teaching by professionals

We employ some of the most well-known and experienced tutors in the industry who specialise in tax training. Our dedicated tutorial and client services team, whose unrivalled knowledge of the examinations and your options means that all your queries can be answered in one place. We offer the best service because our sole purpose is to provide training and advice for the tax examinations

Tolley Exam Training is uniquely placed to offer your students the papers they wish to sit to complete the Tax Pathway at locations across the UK. For full details on the Tax Pathway including suggested combinations of papers to meet particular routes or specialisms and also pitfalls to avoid please go to www.tolley.co.uk/taxpathway.

Discover our core products