May 16th, 2017

While every attempt will be made to ensure that information provided is accurate at the time of publication, it should be treated as guidance only and does not constitute legal or professional advice. Tax law and guidance changes frequently and readers are advised to consult the current relevant product for the most up-to-date information on this topic.

This article was originally produced for Taxation 19 April 2017.

Author: Steve McIntyre

KEY POINTS

- The preparation of year end accounts can be a good time to review indirect taxes.

- The VAT registration limit applies on a 12-month rolling basis and must be monitored.

- Care needed with partially exempt businesses; does the de minimis rule apply?

- If property is involved should an option to tax be made?

- The capital goods scheme can be relevant when use of expensive assets changes.

Some say 'VAT is a simple tax.' If that was ever true, those days are gone. Yes, many things we buy have 20% VAT charged on them and we know as consumers that we pay the tax, but the multiplicity of rules and regulation in the VAT system now make it a complex tax for many businesses to administer.

Even if a business is fully taxable (charging VAT on all its sales and claiming all its related VAT on costs) it still has several options in accounting for the tax. Further, it is easy to become involved in complex VAT transactions and a package of penalties and surcharges. Businesses need to be aware of these to steer a safe course through the registration, return compliance and opportunities within VAT.

This article aims to provide some tips on VAT issues (and a few pointers on customs duty) that should be considered when preparing year-end accounts for clients. Although there are many other issues that need to be covered at year end, making time for the consideration of these indirect taxes and how they affect a client's business can prove profitable, as well as demonstrating effective risk management.

I have categorised my tips under four headings:

- VAT registration;

- partial exemption;

- international issues; and

- land and property.

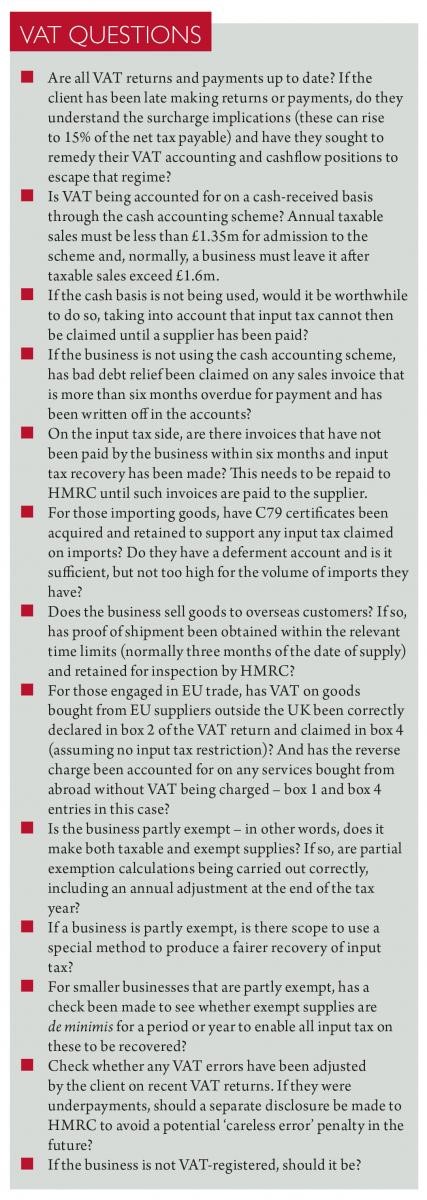

These are areas where some of the most complex and costly VAT issues can arise. But first there are a few VAT Questions that could be asked during the end-of-year accounting process. Although the list is not exhaustive, they may help to refine areas that require further review and HMRC may examine these during any future VAT inspection.

VAT registration

The VAT registration limit applies to historic turnover on a 12-month rolling basis. Thus, and particularly if a business is approaching the limit, income should be monitored regularly to ensure the business registers at the correct time.

It is the 'person' who is required to register, not the business or businesses carried on. Thus, if a person is operating more than one business, even though they are dissimilar, all of their business activities count towards the VAT registration limit and must be covered by one registration. However, it is only necessary to account for supplies of goods and services made in the UK, other than exempt supplies. Therefore, any turnover from goods and services supplied outside the UK can be excluded from the calculation. Services that are treated as outside the scope of UK VAT under the place of supply rules would fall under this category.

Also excluded is any income from activities that can be shown to be personal or 'non-business'. For example, a sole proprietor may have a holiday cottage they use themselves and let family and friends use for a contribution towards costs.

A business can still register for VAT if it only makes supplies outside the UK that would be taxable supplies if made here. This allows the business to claim VAT on its UK costs.

Likewise, a business that can demonstrate to HMRC that it intends to make taxable supplies can register for VAT and claim VAT on its costs.

A business that makes exempt supplies only and therefore is not ordinarily liable to register may have to do so if the value of services that are supplied by overseas businesses exceeds the registration limit. This is due to the 'reverse charge' mechanism, under which the customer is liable to account for VAT on the supply rather than the overseas supplier. This will result in VAT payable to HMRC by such an exempt business because it must calculate output tax on the supplies received, but cannot claim the input tax due to its own exempt status.

Partial exemption

A registered business that makes both taxable and exempt supplies cannot charge VAT on the exempt supplies and equally cannot, normally, reclaim the VAT incurred on the purchases used to make those supplies.

Input tax that cannot be claimed because it relates to an exempt supply, is known as exempt input tax and the registered business is partly exempt.

This status requires it to identify the input tax that is directly attributable to its exempt supplies and that which is directly attributable to taxable supplies. Any that cannot be directly attributed is residual input tax and must be apportioned to identify the amount that relates to exempt supplies. This can be calculated by either using the standard method, which uses an income-based apportionment or a special method agreed with HMRC.

Having calculated its total exempt input tax, a business can be treated as fully taxable (thereby enabling it to recover all exempt input tax) in any tax period or longer period (normally its VAT year, ending March, April or May depending on when its VAT returns are due) if the total value of its exempt input tax is not more than:

- £625 a month on average; and

- half of its total input tax in the relevant period.

The total value of exempt input tax is that which is directly attributable to exempt supplies plus the proportion of any residual input tax that is attributable to exempt supplies.

Total input tax excludes blocked input tax (such as VAT on the costs of business entertainment), which is irrecoverable.

Two simplified tests for checking whether a business is de minimis are outlined in HMRC's Notice 706: partial exemption.

Land and property

Dealings in land and property can result in complex VAT issues. For example, if a business that makes wholly taxable supplies within its normal activities has surplus warehouse or office space that it decides to let, income deriving from this will normally be VAT-exempt. Consequently, the business has become partly exempt and must undertake the calculations outlined above and potentially restrict its VAT recovery.

But the result can be different if, say, the business decides to opt to tax the property before letting starts, or the tenant is using the property for self-storage. Both of these supplies are subject to VAT, so the business remains fully taxable.

As with supplies generally, it is important here that the VAT liability should be considered before the supply is made (in other words, before a tax point is created) because that is when the VAT is due. In most cases, it is too late to change the VAT liability after the supply has been made.

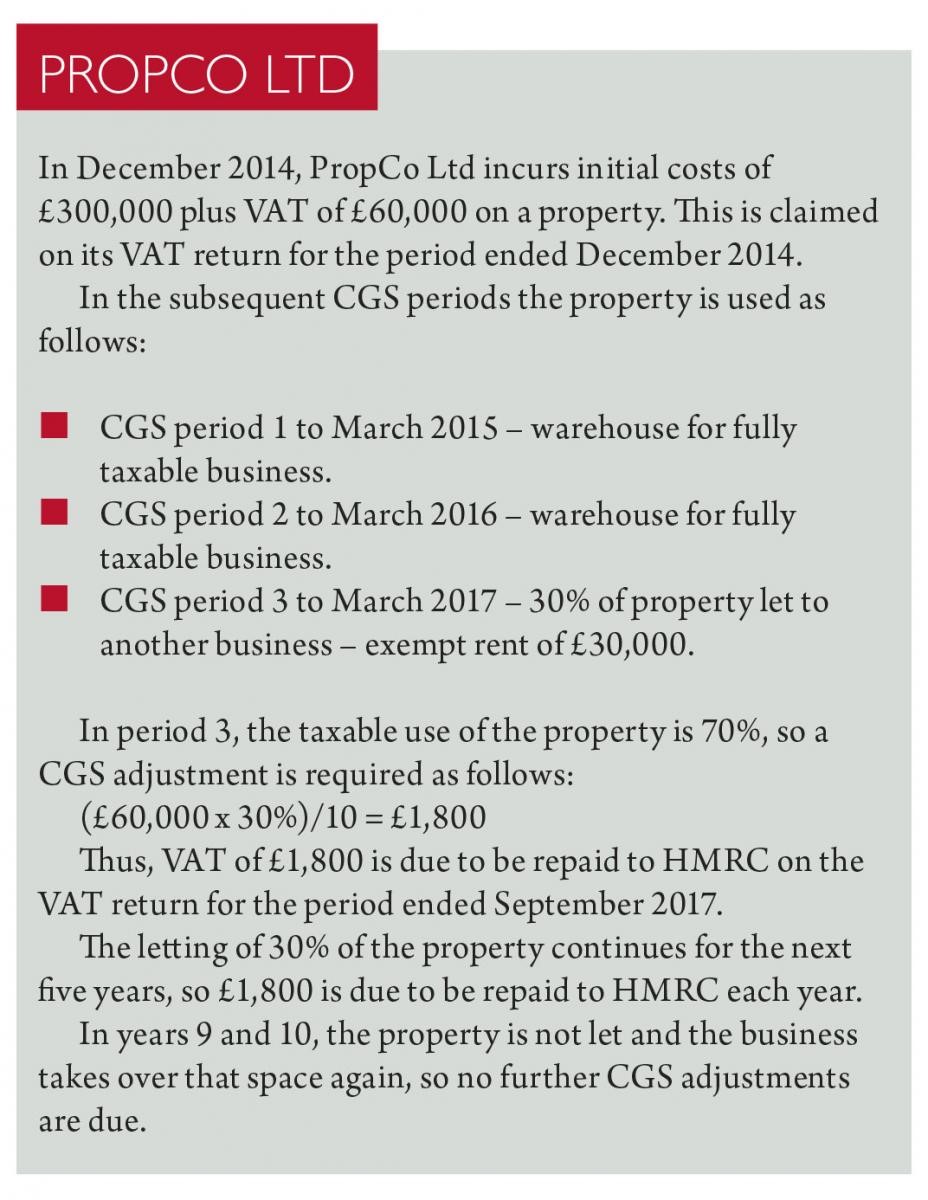

A further complication could feature in the property letting scenario outlined above. If the business premises originally cost more than £250,000 plus VAT when it was purchased (or more than £250,000 plus VAT has been incurred on extension, refurbishment or fit-out works on the property since that time) and either of these has occurred in the past ten years, the capital goods scheme (CGS) must be considered.

The CGS requires the taxable use of such an asset to be monitored over ten periods (normally years) and, if that usage differs from that in the first period in which the VAT was recovered, an adjustment needs to be made. The example of PropCo Ltd illustrates this.

International issues

International trade was mentioned in VAT Questions. However, some areas involve customs duty rather than VAT. Although import VAT will be recoverable by a VAT-registered business as with other VAT costs, customs duty is not recoverable. Therefore, it is important that the business pays the correct rate of duty on its imported goods.

This is another area of taxation of which import businesses need to be aware. Some questions that may be relevant and where further advice should be sought are as follows.

- Has the client checked that the imported goods have been correctly classified for customs duty purposes?

- Does the client have a deferment account?

- Is the business a long-standing compliant trader with HMRC? If so, should it apply for simplified import VAT accounting (SIVA), which could save money on providing guarantees?

- Are some of the imported goods being re-exported? If so, could the business benefit by using a duty suspension regime, such as customs warehousing or inward processing relief.

And for the future…

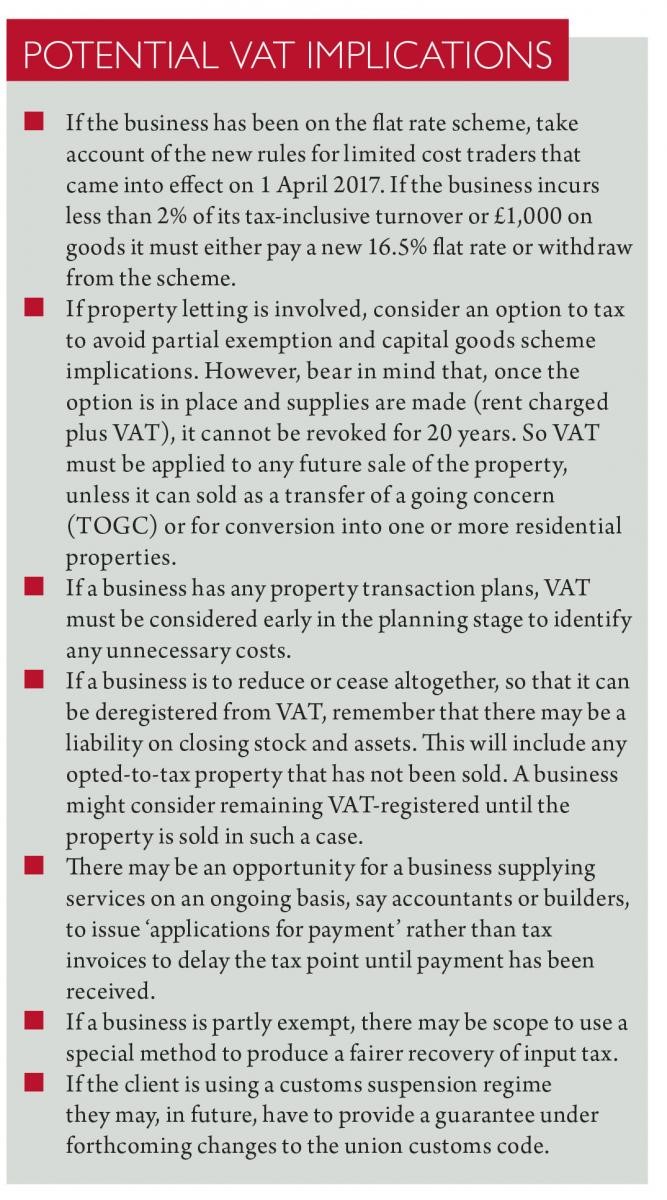

At some point during the end-of-year accounting process many advisers and their business clients will discuss the forthcoming year and future plans.

Potential VAT Implications outlines some thoughts that should be considered.

- Lorem ipsum dolor sit amet, consectetur adipiscing elit.

- Proin ac leo sollicitudin, sodales dui sagittis, porttitor nisi.

- Mauris lacinia nisl non risus blandit pellentesque.

- Integer fringilla velit lorem, vel bibendum neque cursus id